The prettiest two words you ever want to hear when investing are: Compounded Interest. A perfect case comes from the one and only Benjamin Franklin.

The prettiest two words you ever want to hear when investing are: Compounded Interest. A perfect case comes from the one and only Benjamin Franklin.

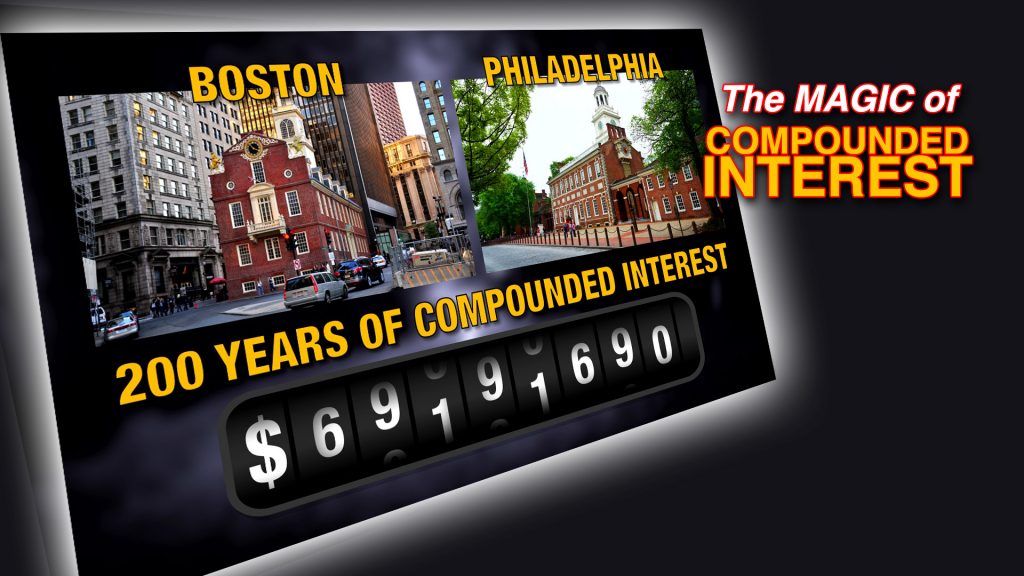

Franklin decided to leave about $4,550 at the time of his death each to his native hometown of Boston and adopted hometown of Philadelphia on the condition that it gather interest for 200 years. Franklin believed 200 years was the maximum length of time any person should be able to control assets from beyond the grave.

It could have theoretically reached well over $78,000,000 if the two cities had never spent any and had managed it well.

The point of Franklin’s experiment was trying to illustrate the tremendous power of compound interest for future generations. The longer you keep your money invested, the more amazing the power of compound interest. So start saving today, and put your money to work for you! You’ll have a case with a happy ending

Want to read more about Franklin’s amazing gift? Here’s a NYTimes article: http://www.nytimes.com/1990/04/21/us/from-ben-franklin-a-gift-that-s-worth-two-fights.html

I’m Frank Money, and I wanna help you investigate everything about money! For example, let’s investigate savings. It doesn’t take much detective work to understand that savings is good for you!

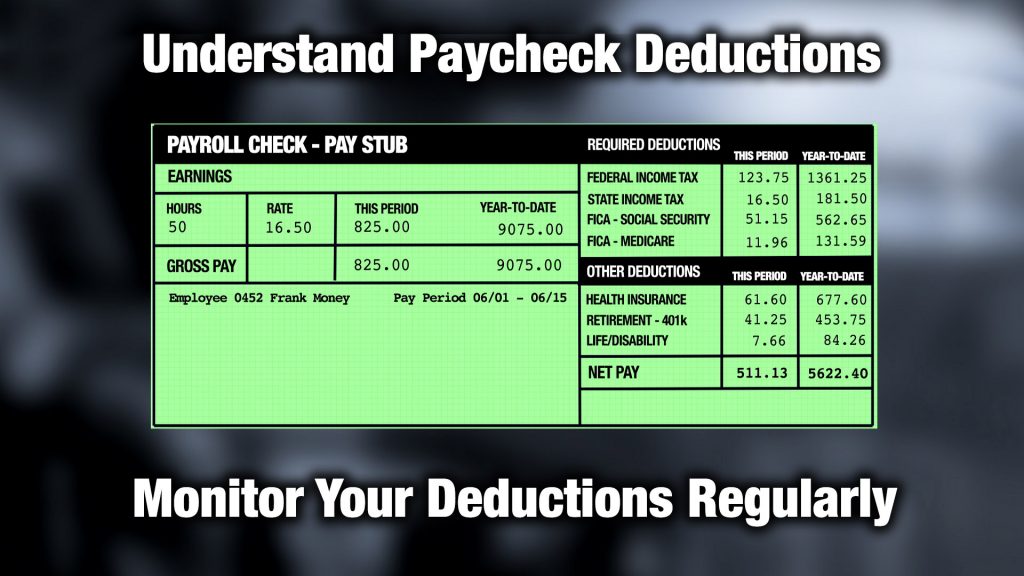

I’m Frank Money, and I wanna help you investigate everything about money! For example, let’s investigate savings. It doesn’t take much detective work to understand that savings is good for you! Getting your first paycheck is an exciting thing. Then you look at the actual amount of the check and you think there must have been a mistake! That’s because they take out taxes and employee benefits from you pay. You should take the time to understand what they deduct from your paycheck, and why.

Getting your first paycheck is an exciting thing. Then you look at the actual amount of the check and you think there must have been a mistake! That’s because they take out taxes and employee benefits from you pay. You should take the time to understand what they deduct from your paycheck, and why.

Student loan debt is a big issue. It is the most common way of funding your college and graduate school education – but doing so has become a ‘Game of Loans’. And since money is my game, you’ll also note it’s my name…. Frank Money that is!…See what I did there?

Student loan debt is a big issue. It is the most common way of funding your college and graduate school education – but doing so has become a ‘Game of Loans’. And since money is my game, you’ll also note it’s my name…. Frank Money that is!…See what I did there? Attention, now, listen up! It’s important to have a personal financial plan. Here is the top ten list for everyone, that will help you with smart money practices and habits:

Attention, now, listen up! It’s important to have a personal financial plan. Here is the top ten list for everyone, that will help you with smart money practices and habits: There’s one private investigator who’s middle name is ‘Identity Theft’! Talkin’ Money’s own Frank Money!

There’s one private investigator who’s middle name is ‘Identity Theft’! Talkin’ Money’s own Frank Money! There’s one private investigator who’s middle name is ‘Organized’! Talkin’ Money’s own Frank Money!

There’s one private investigator who’s middle name is ‘Organized’! Talkin’ Money’s own Frank Money! Identity theft is a serious problem. If someone gains control of your personal information they might be able to open accounts, file taxes and make purchases in your name – and THAT would be a major heist.

Identity theft is a serious problem. If someone gains control of your personal information they might be able to open accounts, file taxes and make purchases in your name – and THAT would be a major heist. You’re young and just starting out in the workforce and lucky enough to be able to join in an employee sponsored savings plan (ESP).

You’re young and just starting out in the workforce and lucky enough to be able to join in an employee sponsored savings plan (ESP). Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. I’m detective Frank Money – and I’m the man for understanding Career Plans.

Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. I’m detective Frank Money – and I’m the man for understanding Career Plans.